Thursday, July 12, 2018

A BCH Fueled Version of Patreon is Coming This August

Thursday, July 5, 2018

Malta Passes Blockchain Bills Into Law, ‘Confirming Malta as the Blockchain Island’

Syscoin Hack Disrupts Binance Prompting Temporary Shutdown

Sunday, July 1, 2018

RipaEx — DPOS Financial Ecosystem

RipaEx is a project build on two pillars:

1. Ripa Exchange: an open source exchange based on the source code of Peatio (www.peatio.com)

2. Ripa Blockchain: a DPOS blockchain with its own XPX token that will serve to share liquidity between all Ripa Exchanges in the Ripa network

The development of the project will follow the paradigm:

1. Ripa Exchange: paid contribution to the community for making a modular, secure and UI responsive exchange starting from the source code of Peatio

2. Ripa Blockchain: all the latest features of ARK will be merged in our GitHub reposistories, as Ripa Blockchain is an ARK fork we will always entrust ARK as our technology provider and paid contribution will be done for porting ARK features into Ripa codebase (ARK 2.0, libraries, true block weight software, others application…)

To make the return of investment to the investors of the RipaEx project we will proceed on two paths:

1. Technical/Technological: the XPX token has a purpose as explained in the introduction of chaper "4. The Ripa Blockchain" of the whitepaper, we will push for broader use of the XPX token in our ecosystem and in the ecosystems that find added value to our token.

2. Economical: XPX tokens not covered by explandeable funding during the Ripa ICO (PreSale and RIPA TEC phases) will be burnt forever to avoid speculation on the token remaining as explained in section "5.3. XPX Ripa Token Distribution" of the whitepaper.

Current exchange phase is:

Phase: PreSale

Phase Ending: Sunday 09/30/2018

Exchange Rate: ₱/€0.10

Accepted Coins: BTC, ETH, ARK, LISK (contact us for more…)

Bonus: 100%

Soft Cap: 25 BTC

Current airdrops are:

1. ₱125 for first 1,000 users that join our Telegram or Slack channel and like our Facebook or Twitter page

2. ₱500 for setting up a node

3. €1,000 in trading fees on the first Ripa Exchange if you invest at least €100.00 in the project

For any doubt, suggestion or if you are just curious I invite you to join our Telegram, Slack or Gitter channels and learn more about our project in the links below:

Website: www.ripaex.io

Bitcointalk ANN: bitcointalk.org/index.php?topic=3759172

Whitepaper: github.com/RipaEx/whitepaper/raw/master/eng/RipaEx_WP_EN.pdf

Facebook: www.facebook.com/ripaex

Twitter: twitter.com/ripaex

Telegram: t.me/ripaex

Slack: ripaex.slack.com

Gitter: gitter.im/RipaEx/RipaEx

GitHub: github.com/RipaEx/

Medium: medium.com/ripaex

Friday, June 29, 2018

Pornhub Adds New Tokens, Fcoin Defends Trans-Fee, Coinbase Goes Pro

NBA Team Mines Ethereum

Thursday, June 21, 2018

What Is a Decentralized Autonomous Organization?

North Carolina Banking Bill Passes — Adds Virtual Currency License Requirements

Thursday, June 14, 2018

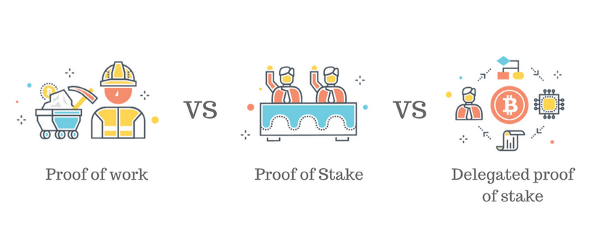

Delegated POS vs POW and why Ripa Exchange is on the right track

Proof of Work can be thought of as the traditional method Blockchains use to validate and finalize transactions. In fact, many of the major cryptocurrencies still use this methodology including Ethereum and Bitcoin.

The way Proof of Work validates blocks:

Miners within the system are required to process and finalize transactions using very complicated algorithms. This has an immediate and somewhat counterproductive impact on the performance of the network as a whole. This is also one of the reasons why Bitcoin is yet notorious for serious delays when completing transactions.Although many still the advantage of such a system enhances network security making it virtually impenetrable. But it places undue strain on electricity, requires plenty of workspace, and demands extra cooling as well.

How DPOS is different to POW and POS?

Delegated Proof of Stake, and DPOS for short takes a completely different approach to transaction validation. The first difference is that miners are chosen specifically who hold fair amounts of tokens on the network. And they are rewarded with amounts of the cryptocurrency for the duties of producing blocks and confirming transactions.

The incentives, therefore, provide a layer of social trust across the entire network. But the biggest benefit is that DPOS turns out faster with this

streamlined approach.

Why DPOS is better then POW

Clearly, the greatest advantage DPOS has over POW is speed. Transactions can now be completed in seconds. And thousands of transactions per second do not stress the network in any noticeable ways.Energy requirements are also significantly cut down, and the system is more efficient overall. The best part is security is not hampered in any way. DPOS is also way more decentralized than POW.

How RIPAEX working on DPOS is a very solid and innovating project

Ripa Exchange — which promises to remain free of charges to its constituent membership, is making exclusive use of the DPOS protocol. This will ensure transactions are quick, secure and with many extra benefits to its members.

With DPOS people are not randomly selected for the purpose of delegation. They are voted in by existing members of the network. Those with the most votes are called Witnesses.

In a sense, the network is run mainly under the direction of ordinary people. There is a bold spirit of democracy inside the system of DPOS which encourages miners to prove themselves.

As the network gets bigger, Witnesses find themselves competing with one another. This results in each of them trying to perform better as time goes on. They also have to pay attention to following set protocols, since they are in a sense governed by the people in the rest of the network. This helps to keep everyday operations running fair, compliant and efficient.

Hurry! Join the RIPAEX presale now and receive 100% bonus http://www.ripaex.io

RIPA BOUNTY Campaign:

Participate in the bounty campaign and reserve yourself a slice of the ₱3,750,000 XPX allocated!!https://bitcointalk.org/index.php?topic=4447278